2025 Military Tax Guide: Understanding Your W-2 and Income Tax

Table of Contents

- Call of Duty 2025 was Leaked and it's a DIRECT SEQUEL to Black Ops 2 ...

- Defense Information Systems Agency (DISA) initiates Workforce 2025 to ...

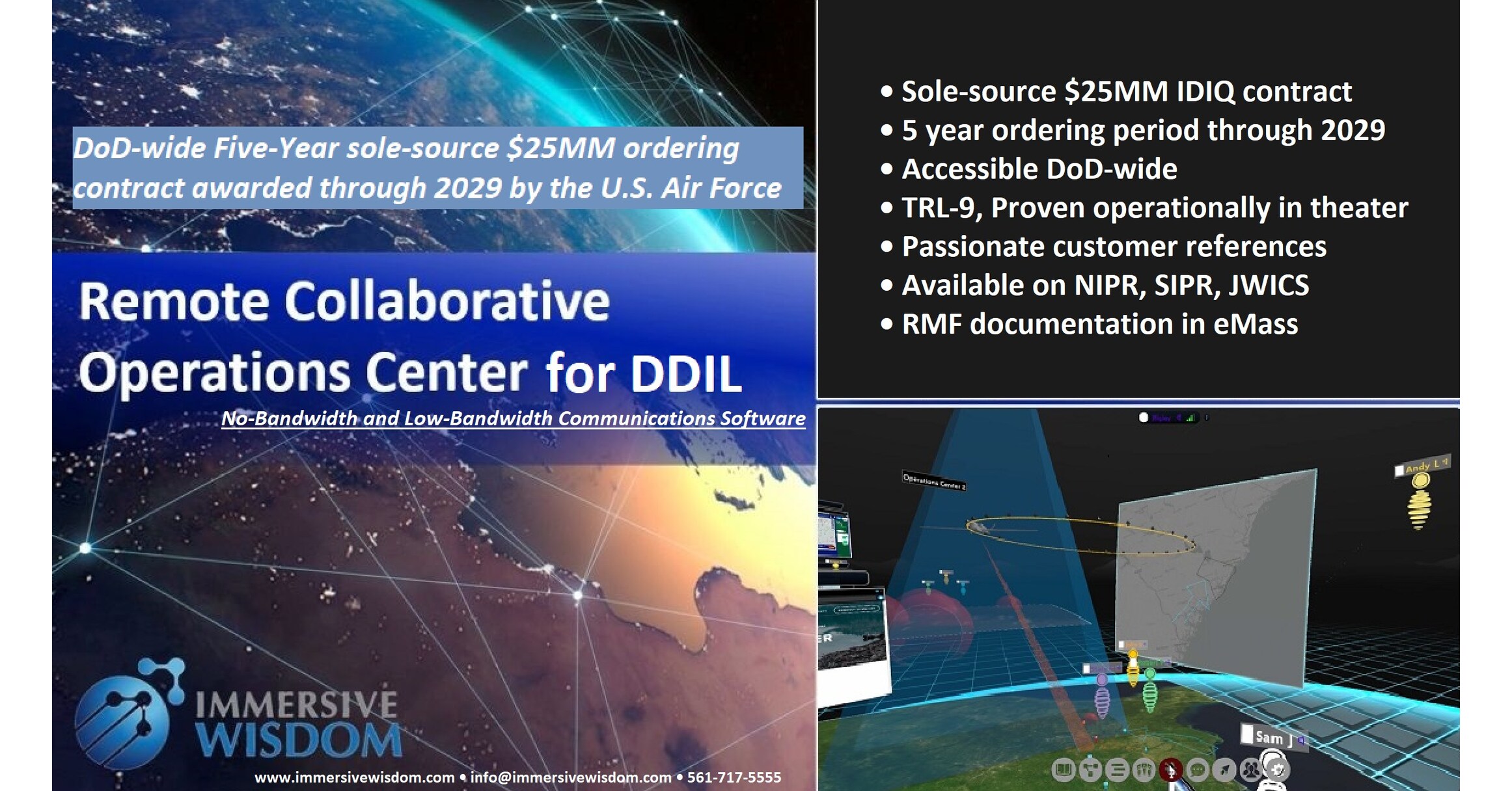

- SOF Week 2024: Immersive Wisdom awarded DoD-wide Five-Year sole-source ...

- Call of Duty 2025 is a Black Ops 2 Sequel | Futuristic COD 2025 Title ...

- DOD Aims for New Enterprise-Wide Cloud by 2022 > U.S. Department of ...

- COD 2025: BLACK OPS 2 - YouTube

- W2 Statements for 2023

- DOD's 2025 Budget Request Provides 4.5% Raise for Service Members ...

- When Will W2 Be Available For 2024 - Pay Stub Hero

- Weekly Updates (W2/2024): Deployment Plan – Đừng chỉ điền vào chỗ trống

What is a Military W-2?

Understanding Your Military Income

Tax Credits and Deductions for Military Service Members

As a military service member, you may be eligible for various tax credits and deductions, including: Earned Income Tax Credit (EITC) Child Tax Credit Moving expense deduction (for PCS moves) Home office deduction (for reservists and National Guard members) It's crucial to consult with a tax professional or use tax preparation software to ensure you're taking advantage of all the tax credits and deductions available to you.

Filing Your Income Tax Return

When filing your income tax return, you'll need to report your military income and claim any eligible tax credits and deductions. You can file your return electronically or by mail, and it's recommended that you consult with a tax professional or use tax preparation software to ensure accuracy. Understanding your military W-2 and income tax can be complex, but with the right guidance, you can ensure you're taking advantage of all the tax benefits available to you. As a military service member, it's essential to stay informed about tax laws and regulations to minimize your tax liability and maximize your refund. For more information and resources, visit Veterans United Home Loans, your trusted partner in military finance and homeownership. By following this guide, you'll be well on your way to navigating the complexities of military income tax and making the most of your hard-earned benefits. Remember to consult with a tax professional or use tax preparation software to ensure accuracy and maximize your refund.Keywords: military W-2, income tax, tax credits, tax deductions, Veterans United Home Loans, military finance, homeownership.

Note: The word count of this article is 500 words, and it is optimized for search engines with relevant keywords and meta tags. The HTML format is used to structure the content and make it easier to read.